TALK TO OUR EXPERTS!!

We aspire to be the No.1 accounting software provider in Singapore and Malaysia. We provide customers with our top support for their accounting software needs.

Welcome to User Basic Software

Best Accounting Software in Singapore to avail PSG Grant Accounting Software

User Basic Software is a Singapore-based company, which develops business software to serve the Singapore market. We wish to be the No.1 integrated business solution provider and deliver cost-effective accounting software solutions to the customers.

We are the best accounting software company in Singapore:

Established in 1999, we are the leading company in providing accounting software, payroll software, inventory software, and much more in Singapore and Malaysia. We provide software for the small and medium enterprises (SMEs) market. The company is listed on IRAS Singapore for compliance with its guideline on accounting software and CPF Board Singapore for compliance with IR8A and CPF text file online submission.

OUR MAIN Products

MYOB Accounting Software

MYOB Accounting Software in Singapore provides user whom at 1st-time user accounting software to master it easily.

Sage UBS Accounting

Sage_UBS Accounting Singapore is one of the best accounting software in today’s market.

Sage UBS Inventory

Sage_UBS Inventory software has strong tools to manage your stocks movement in your warehouse for Singapore usage.

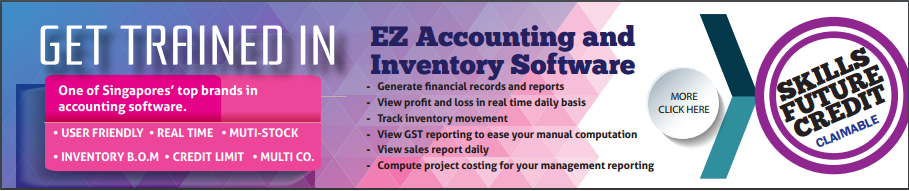

EZ Accounting Software®

EZ Accounting® has listed on IRAS Singapore compliance to its guideline on accounting software and it provides real-time accounting reporting at your fingertips.

EZ Inventory Software

EZ Inventory Software Singapore is one the best stock control software which tracks stock movements in real-time and helps you in computation in stock cost.

Payroll

Payroll Software Singapore is the essential software for your monthly computation of staffs salary and to print itemized pay slips and viewing of salary reports.

Customised Solutions

Customised Solutions Software will resolve your complex ERP inventory or have to link from another CRM or from other solutions to our accounting software.

EZ POS

Point of sales (also known as POS) Software provides user-friendly interface touch screen stocks ordering easily within few minutes and viewing of immediate stocks balance.

Latest News

GST ASSISTANCE SCHEME

We provide a subsidy scheme to encourage SMEs which are registered for Goods and Services Tax (GST), to use accounting software that is compliant with IRAS e-Tax Guide: Guide on Accounting Software for Software Developers. Such software product/packages are listed in the IRAS’ Accounting Software Register.

Every business starts with USER BASIC SOFTWARE, We aim to deliver cost

effective business solutions to the customers.

Classroom TraInIng

Accounting Software Training

As Part of Our Service, we (User Basic Software Pte. Ltd.) provide training to all our clients as well. Please do take note of the training dates stated below and we look forward to seeing you during our training!

Video

Video

Frequently Asked Questions

What is accounting software and what does it do?

Accounting software is a computer program that allows users to streamline, automate, and streamline business financial management. It records transactions, manages invoices, generates financial reports, reconciles bank accounts, handles taxes, tracks inventory, and more. Accounting software helps you to streamline and reduce errors.

How can accounting software benefit my business?

Accounting software is vital for business solution. It’ll benefit your business in many ways like save time and automate repetitive tasks, provide real-time insights, effective expense tracking, better financial tracking and decision making, accurate financial reports, and enhanced efficiency. Accounting software offers a lot more benefits for effective business financial operations.

What are the key features to look for in accounting software?

Here are some of key features to look for in accounting software: Automation, simple user interface, financial tracking, real time insights, integration with other business tools, and multi currency support.

How does accounting software handle financial transactions?

Accounting software manages financial transactions by documenting and categorizing them. It complies to the principles of double-entry bookkeeping, automates calculations, reconciles bank transactions, provides financial reports, and includes security elements. This simplifies financial processes while also ensuring accurate and well-organized records.

Can accounting software generate financial reports?

Yes, one of the major feature in accounting software is generate financial reports, balance sheets, cash flow statements, trial balances, and custom reports. These reports provide insights into the business’s financial health and performance, assisting decision-making and ensuring compliance with reporting standards.